Deferred Income Double Entry

Current Tax Expense Dr. Money that is earned from doing work or received from investments.

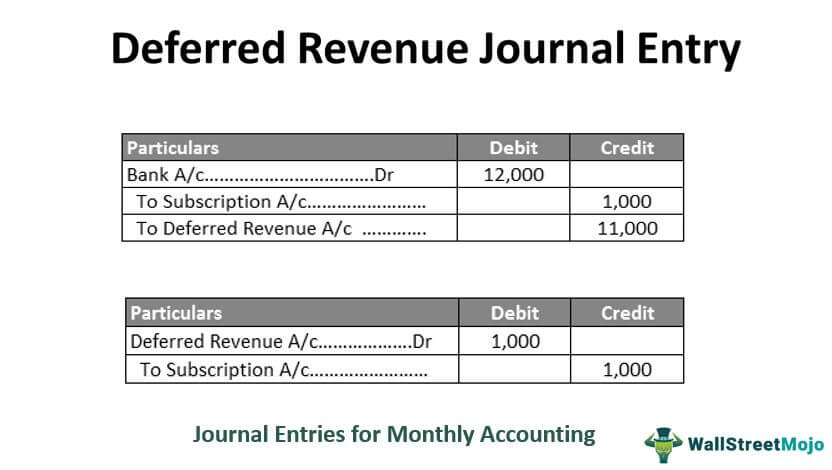

Deferred Revenue Journal Entry Double Entry Bookkeeping

Such taxes are recorded as an.

. The amount of 400 is transferred from the gift cards liability account deferred revenue in the balance sheet to the revenue account in the income statement. In that case the excess tax paid is known as deferred tax asset Deferred Tax Asset A deferred tax asset is an asset to the Company that usually arises when either the Company has overpaid taxes or paid advance tax. Past simple and past participle of defer 3.

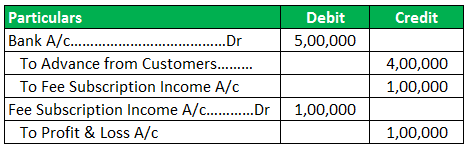

The adjusting journal entry will be between a revenue and a liability. Defer if the cash has been received but the revenue has not yet been earned unearned. Journal Entries for Deferred Tax Assets.

If the tax rate is 30 the Company will make a deferred tax asset journal entry Deferred Tax Asset Journal Entry The excess tax paid is known as deferred tax asset and its journal entry is created when there is a difference between taxable income and accounting income. Deferred revenue is a liability of the business and is sometimes referred to as unearned revenue. The journal entry for deferred tax asset is.

Gift Card Breakage Gift cards can be issued with an expiration date and the revenue associated with them can be recognized when they are either used or on expiration of the card. The adjusting journal entry will be between a revenue and an asset account. Suppose a company has overpaid its tax or paid advance tax for a given financial period.

Past simple and past participle of defer 2. A companys profit in a.

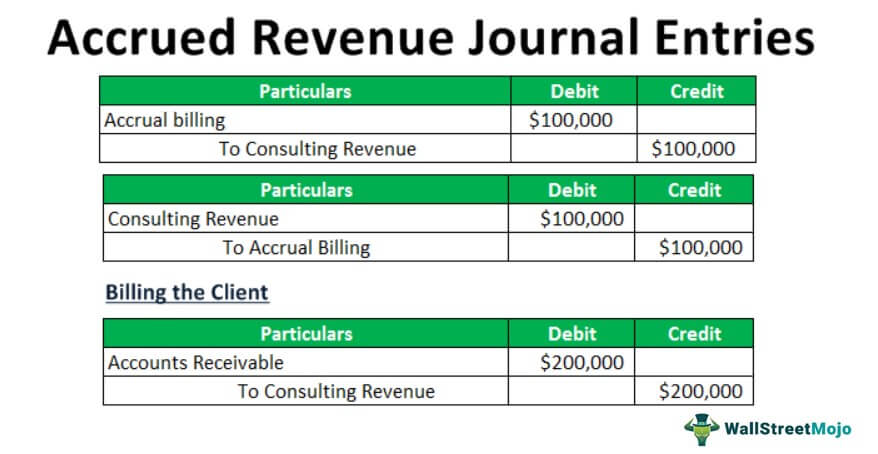

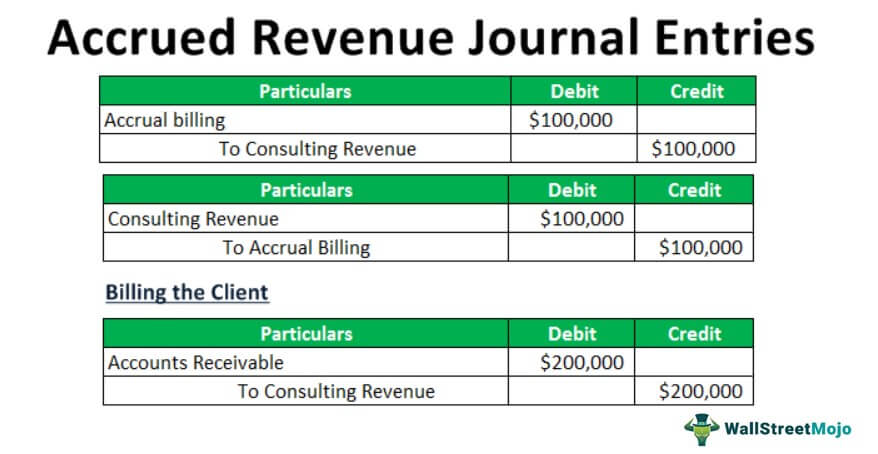

Accrued Revenue Accounting Double Entry Bookkeeping

Deferred Revenue Journal Entry Step By Step Top 7 Examples

Deferred Revenue Journal Entry Step By Step Top 7 Examples

Accrued Revenue Journal Entries Step By Step Guide

0 Response to "Deferred Income Double Entry"

Post a Comment